IN SUMMARY:

In this article, we use an example to explain why property developers who think they don’t need an AFSL to comply with the law are almost always wrong – and what the consequences are for these developers, those who assist them, and their investors.

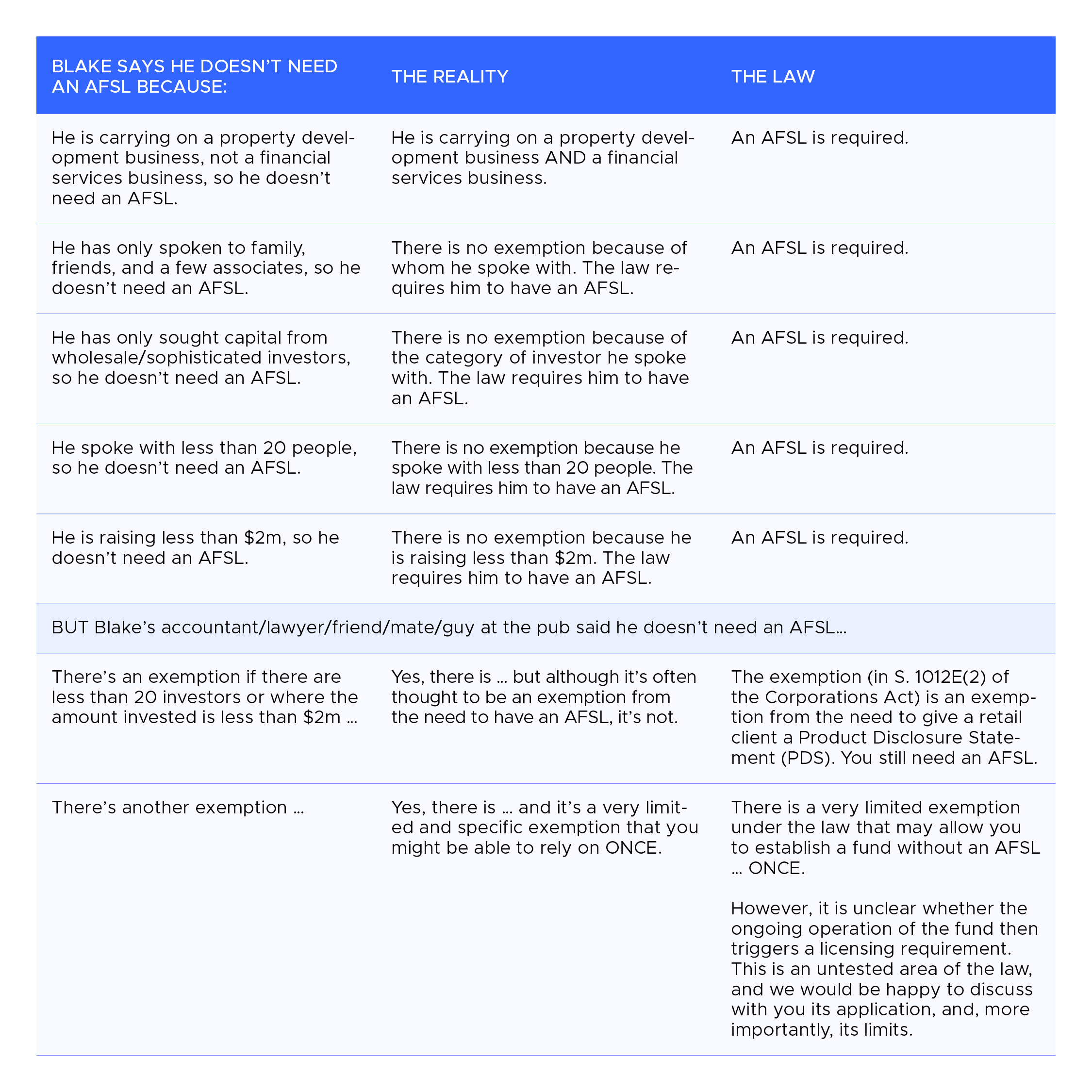

In our article An AFSL is a legal requirement for virtually every person that raises money we explained that property developers who think they don’t need an AFSL to comply with the law are almost always wrong. This example explains why, as well as the consequences.

Meet Blake – a successful property developer looking to raise money

Blake is a successful property developer. He has developed residential apartments for 15 years, funding those developments from bank debt and his own resources. Due to his success, several family members, friends, and a few associates want to invest in his next project.

Blake is keen on the idea as it will enable him to take on larger developments and reduce his dependency on his own funds. He found a new development project and, on his accountant’s advice, set up a unit trust as the development entity.

Blake prepared a summary of the development project, outlining the projected revenue, costs, bank debt, time to complete and the likely returns to investors.

He compiled a list of the family members, friends, and associates who had shown an interest in investing in his next project and called each of them.

On the call, he told them about the project and why he thinks it is a good investment, noting their level of interest. After the call he emailed the project summary to them and followed up a week later to ascertain their commitment.

The reality of AFSL requirements for property developers according to the law

What are the consequences for Blake, those who assist Blake and Blake’s investors?

Although there can be quite severe consequences (including jail time) for Blake and those who assist Blake (such as his accountant or lawyer), the more likely consequence is the appointment of liquidators to the development project who will step in and sell the project in its current state. Blake is likely to be banned from being a company director and prohibited from raising money. The consequences for investors of the sale of the project mid-development could be profound.

Want to learn more about raising private capital and AFSL requirements?

If you’re a property developer looking to raise private capital and want to find out more about what’s involved, get in touch with our team via the Contact page.